Cryptocurrencies have become a significant and disruptive force in the global financial industry. The last year, 2022, proved to be exceptionally volatile for the cryptocurrency sector. Major cryptocurrencies like Bitcoin and Ethereum experienced significant losses, with their values declining by approximately 64% (more than half) compared to earlier periods. Another notable event was the collapse of FTX, a prominent cryptocurrency exchange. FTX faced a liquidity issue of $8 billion, leading to widespread discussions within the crypto community. Additionally, Binance, a major player in the industry, withdrew from the deal to acquire FTX, adding further attention to the troubled exchange. These developments surrounding FTX garnered considerable attention in November 2022. These factors have raised doubts among analysts about the survival and endurance of cryptocurrencies. Nevertheless, despite these challenges, the crypto market still maintains a substantial market capitalization of $1.05 trillion and a global user base of 320 million people in active engagement.

So, with all the turbulence in the past year, do we get to see a steady revival of prices and adoption rates this year? Take a look at what we think 2023 holds for the crypto space!

Increased Allocation Towards Stablecoins

There will be an increase in investments toward stablecoins during periods of market volatility. In the crypto market, stablecoins are recognized for their relative stability in contrast to volatile digital currencies like Bitcoin and Ethereum. As a result, these stable assets serve as an attractive choice for investors seeking to protect their funds during unpredictable market conditions.

Increasing Institutional Adoption

One of the most important trends to look out for is the increasing adoption by institutional investors and traditional financial institutions. In the past, cryptocurrencies were often considered speculative assets or fringe investments. However, in recent years, large banks, hedge funds, and asset management firms have begun to recognize the potential of cryptocurrencies as a legitimate asset class. This institutional interest has led to greater liquidity, improved market stability, and increased mainstream acceptance.

Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) have attracted a lot of attention recently. CBDCs are digital versions of fiat currencies issued and regulated by central banks. Unlike decentralized cryptocurrencies such as Bitcoin, CBDCs are centrally controlled and aim to combine the benefits of digital currencies with the stability and oversight of traditional financial systems. Several countries, including China and Sweden, have already begun piloting CBDCs, while others are actively exploring and considering their adoption. The emergence of CBDCs could have a profound impact on the global financial system, including payments, remittances, and monetary policy.

More Launching of Meme Coins

Having originated in 2013 as a meme inspired by a popular image featuring a Shiba Inu dog, Dogecoin has made significant progress, currently boasting a market capitalization of $13.71 billion as of the time this article was written. The emergence of over 200 meme coins in circulation suggests that this trend is poised to persist in 2023. One of the latest additions to the meme coin category is Tamadodge, which allows users to earn tokens while engaging in gaming activities or purchase them using traditional currency for in-game transactions.

Decentralized Finance (DeFi)

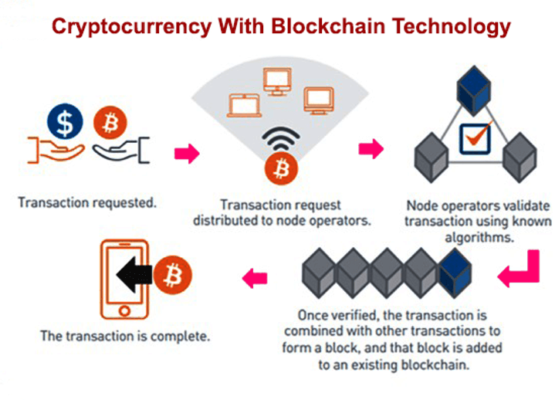

Decentralized Finance, or DeFi, has emerged as a revolutionary concept within the cryptocurrency industry. DeFi platforms use blockchain technology to create an open and permission-free financial ecosystem that operates without intermediaries such as banks or traditional financial institutions. DeFi applications offer various services, including lending, borrowing, decentralized exchanges, and yield farming, giving individuals greater financial autonomy and access to a range of financial instruments. DeFi’s growth is staggering, with billions of dollars tied up in smart contracts, and it shows no signs of slowing down. It is important to note that despite the growing popularity of DeFi, the concept is still in its early stages, akin to the early days of the internet, characterized by chat rooms and basic websites. Just as the internet’s true potential unfolded in the 2000s with digital payments and remote work, DeFi has the potential to bring about transformative changes to the financial landscape as it continues to evolve and mature.

Is the NFTs market dead?

Non-Fungible Tokens (NFTs) have taken the world of art and collectibles by storm in 2021. They are unique digital assets that can represent ownership of a piece of art, collectible, or other form of digital content. The emergence of NFTs has opened up new opportunities for artists, musicians, and content creators to market their work directly and bypass traditional middlemen. NFTs have gained widespread attention through high-profile sales and celebrity endorsements. However, this market is known for its volatility and fast-changing nature. Opensea, the world’s first and largest marketplace for digital collectibles and NFTs, faced a significant decline in monthly trading volume. In January 2022, Opensea recorded a trading volume of $4.86 billion. However, this figure dropped dramatically by 94% to $303 million in October 2022, reflecting a substantial decrease in activity within the marketplace. Even so, there are experts who disagree with the arguments. Some believe the market is dead, others believe it will come back strong this year. Who is right? We don’t know.

All the trends mentioned above are just a few of the ones that we believe will have an impact on the community. They have come a long way since their inception, and the landscape continues to evolve rapidly. Today, the future of cryptocurrencies remains uncertain, despite varying expert opinions. Despite that, it is widely acknowledged that cryptocurrencies are here to stay. Stricter regulations will likely be implemented in the coming years to address these issues and bring more stability and sustainability to the space, along with the emergence of crypto exchanges backed by institutional investors. Moreover, advancements in technology, such as the Metaverse, non-fungible tokens (NFTs), and the opportunity to construct virtual land, present exciting prospects for the crypto space in 2023. These developments have the potential to reshape various industries and create new opportunities. We can just wait and see what the second half of the year brings!