Introduction

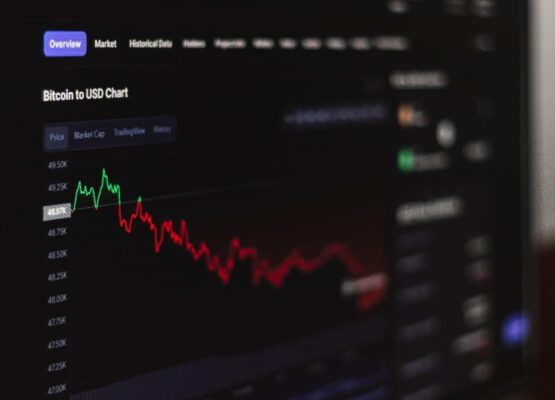

Cryptocurrencies have revolutionized the financial landscape, offering decentralized and secure alternatives to traditional currencies. However, the inherent volatility of cryptocurrencies has often hindered their mainstream adoption. In response to this challenge, stablecoins have emerged as a solution to provide stability in the cryptocurrency market. Stablecoin development services play a crucial role in creating these innovative digital assets that are pegged to stable assets, such as fiat currencies or commodities. In this article, we will delve into the world of stablecoin development services and examine their significance in unlocking stability in the cryptocurrency market.

Understanding Stablecoins

Stablecoins are a special category of cryptocurrencies designed to maintain a stable value. Unlike other cryptocurrencies, stablecoins are pegged to a stable asset, providing a reliable store of value and reducing price volatility. There are different types of stablecoins, including fiat-backed stablecoins, which are backed by reserves of traditional currencies, crypto-backed stablecoins, which are collateralized by other cryptocurrencies, and algorithmic stablecoins, which use complex algorithms to maintain stability. Stablecoins offer benefits such as quick and low-cost transactions, global accessibility, and protection against market volatility. They are also widely used for remittances, decentralized finance (DeFi) applications, and as a medium of exchange in crypto trading.

The Need for Stablecoin Development Services

Developing stablecoins is a complex process that requires expertise in blockchain technology, smart contract development, and regulatory compliance. Stablecoin development services play a crucial role in overcoming these challenges and ensuring the stability, security, and regulatory compliance of stablecoin projects. These services offer end-to-end solutions, from conceptualizing the stablecoin design to implementing and auditing the smart contracts that govern the stablecoin’s operations. By leveraging their technical know-how and experience, stablecoin development companies streamline the development process and help issuers navigate the complexities of the cryptocurrency market.

Key Services Offered by Stablecoin Development Companies

Stablecoin development companies offer a range of services to facilitate the creation and deployment of stablecoins. One of the key services they provide is smart contract development, which involves coding the rules and mechanisms that govern the stablecoin’s stability and functionality. These companies also assist in designing stablecoin protocols and governance frameworks, ensuring transparency and decentralized decision-making. Additionally, stablecoin development services include auditing and security measures to identify vulnerabilities and ensure the robustness of the stablecoin’s underlying infrastructure. Integration with existing blockchain platforms, such as Ethereum or Binance Smart Chain, is another crucial service offered by development companies, enabling seamless interoperability. Furthermore, these companies provide regulatory compliance and legal advisory services to ensure stablecoin projects adhere to relevant laws and regulations.

Factors to Consider When Choosing a Stablecoin Development Service

When selecting a stablecoin development service, there are several factors to consider. Reputation and track record are important indicators of a development company’s credibility and success in the industry. Expertise in blockchain technology, smart contract development, and security measures is crucial to ensure the stablecoin’s stability and resilience against attacks. Compliance with regulatory requirements is also paramount to avoid legal complications and ensure the stablecoin’s legitimacy. Furthermore, the security measures and auditing capabilities of the development company should be evaluated to mitigate potential risks. Flexibility and scalability of the stablecoin solution are essential to accommodate future growth and evolving market dynamics.

Case Studies: Successful Stablecoin Development Projects

Several notable stablecoin development projects have achieved significant success in the cryptocurrency market. Tether (USDT), a fiat-backed stablecoin, has emerged as one of the most widely used stablecoins, providing stability and liquidity to traders and investors. Another successful stablecoin project is DAI, an algorithmic stablecoin built on the Ethereum blockchain, which has gained popularity in the DeFi space. These case studies demonstrate the impact stablecoins have had on the crypto market and various industries, opening up new possibilities for financial innovation and accessibility.

Future Outlook and Potential Challenges

Stablecoins are poised for continued growth and adoption in the coming years. Their stability and potential for mainstream integration make them attractive to both individuals and institutional investors. However, the development and adoption of stablecoins are not without challenges. Regulatory scrutiny and compliance requirements pose potential hurdles, as governments seek to regulate stablecoins to mitigate risks such as money laundering and financial instability. Additionally, ensuring the stability and peg of stablecoins during extreme market conditions remains a technical challenge that development services must address.

Conclusion

Stablecoin development services play a pivotal role in unlocking stability in the cryptocurrency market. These services provide the technical expertise and support necessary to create and maintain stablecoins, enabling reliable digital assets that can drive financial innovation and accessibility. As the demand for stability in the crypto market continues to grow, stablecoin development services will play a vital role in shaping the future of finance, ushering in a new era of stability and reliability in the digital economy.