What is cryptocurrency?

A cryptocurrency is a digital currency that can be used to make payments using encryption algorithms. Due to the implementation of encryption technologies, cryptocurrencies can function as both a currency and a virtual accounting system. You require a cryptocurrency Trading wallet to use cryptocurrency. These wallets could be software that runs in the cloud or on your computer or mobile device. Wallets are the devices you use to hold your encryption keys, which verify your identity and allow you to connect to your cryptocurrency.

How does it work?

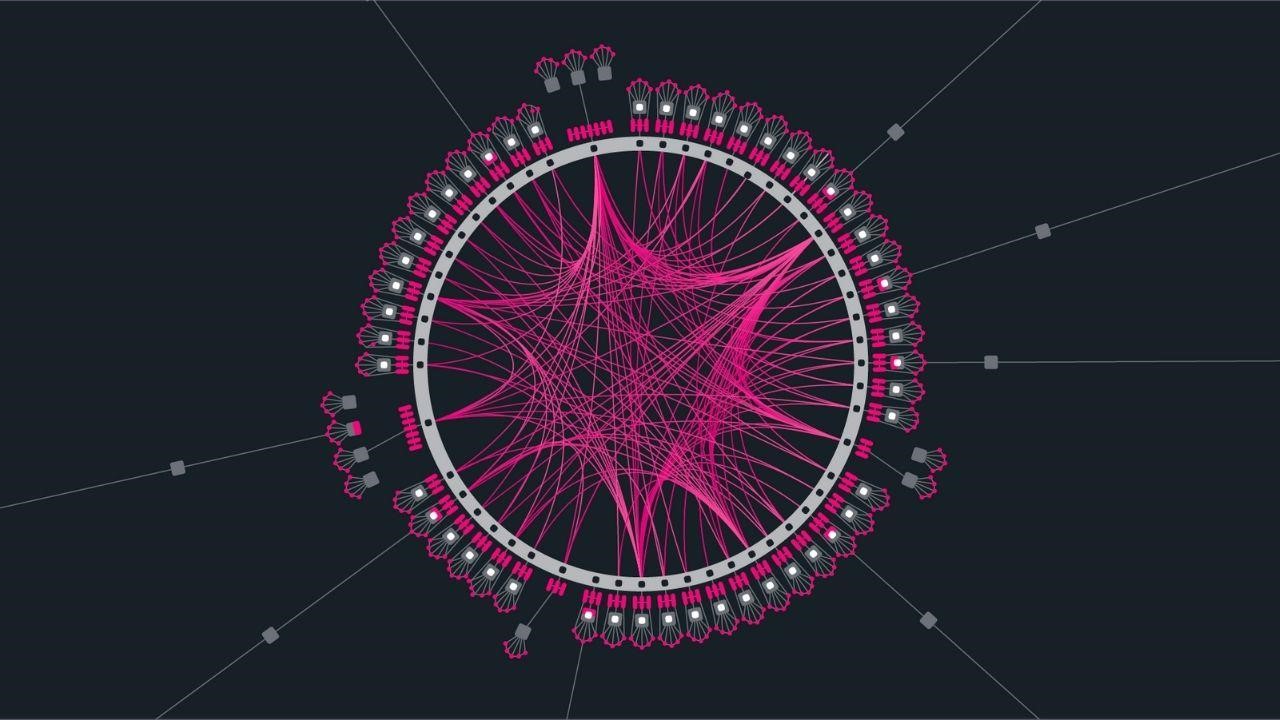

A blockchain is a distributed ledger that maintains your cryptocurrencies. A blockchain includes blocks, which keeps individual transaction data. This information is timestamped and entered into the ledger so that every transaction can be verified by other blockchain stakeholders and can never be changed. Users agree to pay a small fee to conduct a transaction on the blockchain, which helps to maintain the security of the blockchain.

Let’s assume you wish to send a small amount of Bitcoin to your friend. You made a transaction using your Bitcoin wallet and requested to send bitcoin to your friend’s wallet, and willingly pay a nominal transaction fee along the way. Your transaction gets grouped with other transactions into a block on the Bitcoin blockchain after you made the transaction request. This block is checked by miners and posted to the blockchain, completing the transaction.

You can send cryptocurrency to anyone, anywhere in the world, with low transaction fees using this process. Not only will the payment usually be completed in seconds or minutes, but it’ll also charge you a fraction of what you would have paid if you used a traditional money transfer service.

Types of cryptocurrencies

As of 16 February 2023, top 10 cryptocurrencies by market capitalization in USD:

It’s hard to predict which coins will be the most fruitful, as the crypto environment is recent and many cryptocurrencies are young. Although these coins are among the largest, they still carry a risk. The likelihood of investment loss is serious and real. For example, after the strong profit in 2021, the prices of most cryptocurrencies plunged dramatically in 2022. That is why it is critical to learn about each cryptocurrency before investing and determining if the investment makes sense for you.

How are cryptocurrencies created?

Mining, which is used by Bitcoin, is one of the most common ways through which cryptocurrencies are made. Bitcoin mining is an energy-intensive process wherein computers resolve complex puzzles to confirm the legitimacy of network transactions. Owners of those computers may gain newly created cryptocurrency as a reward. Other cryptocurrencies produce and hand out tokens in different ways, and many have a markedly lower environmental impact.

The most convenient way for most people to obtain cryptocurrency is to purchase it from an exchange or another user.

Pros of investing in cryptocurrencies

- Prior to 2022, the value of cryptos was not strongly linked with the prices of other investment classes, such as stocks and bonds, so a minimal access to this presumably high space may enhance risk-adjusted returns. Comparisons between cryptos and other types of assets were high in 2022, but it’s unclear whether this is a new trend.

- Certain cryptos, such as Bitcoin, are compared to gold by some experts: both are fungible and durable because they are difficult to destroy, inadequate due to limited supply, and their buying power is not characterized by any central authority.

- It is difficult to undermine the network integrity of cryptocurrencies due to the distributed ledger’s decentralization and transparency.

The disadvantages of investing in cryptocurrencies

- The cryptocurrency market is extremely volatile; it can be hard to tell when values will soar or dip, and the causes of large price swings are not always obvious.

- Despite the fact that crypto blockchains are extremely difficult to hack, individuals are vulnerable to hacking due to the risks inbuilt in any online activity.

- Because cryptocurrencies are not typically subject to much government regulation, transactions are not legally protected (unlike traditional investments like stocks).

How to invest in cryptocurrency in 2023

Investing in cryptocurrencies grows more accessible by the day. A number of exchanges are available which are alike traditional investments. You can create an account in minutes. But, just like investing in any asset, doing your research on a specific currency before investing may be a wise move. If you can’t stop thinking about how to invest in cryptocurrency for the first time, the following five steps can help you get started.

Step 1: Determine which cryptocurrency to invest in.

You’ll want to know and carefully assess the various, unique characteristics of every cryptocurrency you’re considering for investment in the same way you’d evaluate a company’s potential risks and financial health before buying its stock. You are free to invest in one or more cryptocurrencies.

Because cryptos have become a renowned vehicle for fraud, like pump-and-dump schemes, vetting them can be more difficult. These dangers may have you wondering how to engage in cryptos without becoming a victim of a scam. Keep in mind that it is your responsibility to examine the investment risk of a specific cryptocurrency, and that social media experts may not be acting in your best interests. Although investing through a large, reputable platform may reduce your vulnerability to fraud and cybersecurity risk, it is impossible to eliminate this risk because the entire industry is unregulated.

Step 2: Select a cryptocurrency exchange.

You should buy cryptocurrency via an exchange or investment platform. Consider these factors when selecting an exchange are security, fees, trading volume, minimum investment criteria, and the different variety of cryptocurrency available for buying on a given exchange.

Step 3: Think about storage and digital wallet options.

You will need a digital place to store the coins you owe, since crypto is completely digital. As per Feldman, investment platform is one of the options available. “As the cryptocurrency market has developed, most newer participants choose to store their cryptocurrency investments with the investment platform they’re using,” Feldman describes. “Make sure you choose a platform that will be responsible for the custody and safekeeping of your assets; that type of platform will be regulated, well-protected against hacking and cyber threats, and carry lots of financial insurance,” advises Feldman.

If you don’t want to keep your cryptocurrency on one of the more popular platforms, you’ll need a crypto wallet. These contain the private keys that allow you to access your cryptocurrency by unlocking the digital identity associated with your ownership and recorded on the blockchain. You can choose between a “hot” and a “cold” digital wallet. A hot wallet is more convenient because it is accessible via the internet. A “cold wallet” is a physical storage device, similar to a USB drive, that keeps your cryptocurrency keys completely offline and more secure in general. “Holding your cryptocurrency in a wallet provides an extra layer of protection,” Feldman says.

Step 4: Determine your investment budget.

The amount you choose to place into cryptocurrency, like any other investment, will be determined by a variety of factors, including your budget, risk tolerance, and investment strategy. You should also consider any minimum capital requirement and processing fees, which vary between cryptocurrency exchanges.

If you want to invest in a cryptocurrency with a high value per coin, Feldman mentions that “most exchanges let you invest on a dollar basis rather than buying a whole coin, so you don’t have to produce tens of thousands of dollars to invest in Bitcoin, for example. Focus on the total amount of dollars you want to invest and not the number of coins you want to buy. Also, always remember, never invest more than you can afford to lose.”

Step 5: Manage your investments.

Cryptocurrency is a novel investment because it can be used to purchase things and can also be kept as a long-term investment. Your investment strategy and goals will determine how you manage your crypto holdings.

Alternative ways to invest in cryptocurrency

While investing directly in cryptocurrencies is the most popular method, traders have other options, some of which are more direct than others. These are some examples:

- Crypto futures: Futures are another way to gamble on the price fluctuations in bitcoin, and futures permit you to use the power of leverage to generate massive returns (or losses). Futures are a volatile market that worsens the already volatile movements in cryptocurrency.

- Crypto funds: There are a few crypto funds (such as the Grayscale Bitcoin Trust) that allow you to bet on price fluctuations in Bitcoin, Ethereum, and a few other altcoins. Hence, they can be a convenient way to purchase cryptos.

- Crypto exchange or broker stocks: Purchasing stocks in a company that’s destined to profit on the rise of cryptocurrency irrespective of the winner could be an interesting option, too. And that is the ability of an exchange or a broker, which earns a massive chunk of its revenues from crypto trading.

- Blockchain ETFs: A blockchain ETF enables investing in companies that stand to benefit from the development of blockchain technology. The best blockchain ETFs provide exposure to some of the most important publicly traded firms in the space. However, it is important to note that these companies frequently operate well beyond crypto-related businesses, which means your exposure to cryptocurrency is dissolved, lowering your potential.

You should know exactly what you are buying and if it’s suitable to your requirements as each of these methods differs in its terms of risks and exposure to cryptos.

What is the future of cryptocurrency?

Cryptocurrencies have come a long way in the last ten years, advancing at lightning speed. Value can be stored, transferred and spent in a variety of ways using various assets and solutions and Dei has paved the way for new borrowing and lending pathways.

Some popular companies are also curious about blockchain technology, assessing different uses like supply chains. As per the growth and adoption seen since 2008, when Nakumoto published the framework for a small asset called Bitcoin, the future of cryptocurrency and its associated technology shows massive opportunity.